-

Protecting Value & Succeeding Beyond Recession

By Rob Garner and Simon England

Uncertainty in business is not new, but few would disagree that the current landscape has more than enough of it. Even before the political upheaval and market turmoil seen in the last half of 2022, there had been a gathering of storm clouds: continuing disruption from the Covid pandemic; change to trading relationships brought by Brexit; widespread industrial action; pressure on supply chains as a result of the war in Ukraine; the requirement to respond to the climate emergency; soaring energy prices; inflation and impending cost of living crisis.

Today’s business leaders – including those of us in the consulting sector – are dealing with significant challenges and oncoming threats, all at once and at a scale that can be described as unusual at best.

The Challenge Ahead

There already was a change in business confidence, likely to affect the consulting industry. Until the summer, all market indicators were pointing to sustained demand for professional service support and a strong pipeline of projects from most market sectors, especially around digital transformation. However, in the face of such sustained uncertainty, many businesses are starting to re-think and market commentators are more firmly suggesting that there will be a softening in demand. Clients can find themselves in a ‘Catch 22’ situation – effective advisors were never more needed, yet companies must evaluate which projects can be delivered in-house, or delayed, perhaps cancelled, and for which the input of external expert advisers is vital and time-critical.

Consulting companies face pressure from both sides of this recession, namely: double digit inflation, the drivers of which – unusually – have been supply side challenges, and a reduction in demand for our services as our clients respond to the changing circumstances themselves.

In general it may be that the small and mid-sized projects are those that will be delivered in-house or de-prioritised. According to Source Global Research, on average, 56% of client organisations surveyed over six months say that they’ll be making a substantial investment in digital transformation, 45% say they’ll be investing in responding to climate change and other sustainability-related issues, and just over 40% that they’ll be putting money into workforce and organisational change. However, when it comes to business risk and resilience as well as climate-change related projects, these are areas where organisations state they are least likely to use external consulting help.

At Garwood we would strongly suggest that it has become more important than ever for our industry to clearly express the value that we deliver. Whilst this may seem obvious from a revenue protection perspective, many of our clients will also need help navigating through this business landscape. Ensuring our own houses are in order: our marketing messages clear, our impact measurements precise, and our knowledge up to date, are all key components in providing effective advisory to our end clients.

An approach to consider – Protecting Value

Some of us have seen this before. It’s not new. In 2010 for example, Rob was running Tribal’s consulting practice with c.450 consultants deployed across the public sector. Following the 2010 May general election and the appointment of the Coalition Government, Tribal saw a 45% drop in market activity as austerity bit and the then Minister for Cabinet Office, Francis Maude sought to reduce the Government’s reliance on external advisors.

Protecting Value – The Framework:

We all now know we’re at the start of a recession. The shape – U, V, W – and scale, we’ll leave for others to comment. In addressing the recession, we believe that Professional Service firms will broadly go through three phases.

• Survive – Maybe not quite ‘free fall’ but certainly not having found the bottom and therefore, having to take appropriate actions for today and tomorrow

• Stabilise – Having found the bottom – and confirmed it is firm – starting to plan and build for the future

• Succeed – The reoccurrence of a sense of confidence, an ability to execute on plans and a return to growth

We also believe that there are five themes or subject areas that require specific attention/action during the transition through the three phases.

At Garwood we have developed a framework that codifies the activities by phase and theme. That framework ( and it’s only that and not a methodology) is based on distilling the sum of our respective experience over the last 30 years. We have tried to capture the practical aspects of successfully leading businesses through past downturns

At a headline level …

Protecting Value – Talent

Normally, Professional Service firms have few assets: our leadership and talent are our only real asset. Yet during a downturn, our only asset is also our largest cost drain and typically, the only commodity to enable us to realign the cost base. We have no silver to sell!

Let’s start with our leaders – our first lieutenants

In our experience, not all leaders are suited to all circumstances. Some will excel in times of rapid growth and others will be just great in a crisis. During the recession, you need to bring the calm, objective and decisive to the fore. As such, don’t be afraid to reorganise your top team and even create a cabinet within it.

Don’t be afraid to change the cabinet. Leading through a downturn can be exhausting. Equally, circumstances will change as you transition through the phases, demanding different things of your leadership team. You need to realign roles as circumstances change.

Turning to the wider team … your core talent

Ensure you have the right team to succeed and communicate openly, frequently and sensitively. Against a backdrop of cash burndown, ensuring that you have the right team means assessing objectively your current talent and determining their suitability for the future. That implies also having a view about future markets and value propositions

You may find yourself in the unenviable position of having to exit some staff whilst considering or even actioning the recruitment of others. That’s tough! For the talent you want to retain, you may need to be inventive to protect cash. The days of furlough are behind us so you may need to consider part time working, salary sacrifice (20-40%), sabbatical (20% paid), etc.

For the talent you can’t retain, you will need to exit them objectively and sensitively. You will also need to avoid the law of unintended consequences. In particular, the scenario where you start to lose those you’re trying to retain.

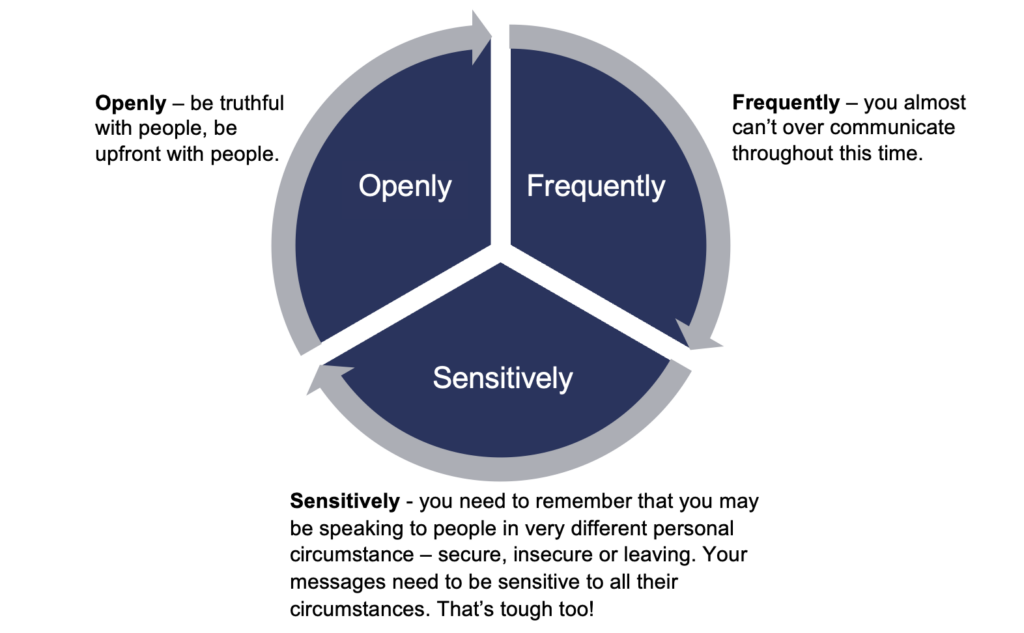

Throughout this time, you also need to communicate openly, frequently and sensitively.

Protecting Value – Finance

Turning to finance there are two main features to consider:

- Action to strengthen your balance sheet

- Forensic management of cash

Typically, actions to strengthen your balance sheet fall into two camps: Reducing costs and/or Injecting new finance into the business

Cost Reduction – As we’ve already established, our leadership and talent are our only asset that enables us to significantly reduce our cost base. We have also already established that we have two options …

- Retain staff but reduce cost through salary sacrifice, part time working, etc. OR

- Exit staff and reduce cost through the reduction in salary bill

In doing the latter, remember that exiting staff has a short term cash impact. You are likely to pull forward cash payments on exit – e.g. paying out notice, redundancy pay, etc. – that may increase your short term cash exposure. The consideration you need to make is this about short term cash protection or longer term P/L rebalancing. Only you will know your businesses specific challenges.

Our supposition is that we all think and hope it’s the former only later on to realise that it’s the latter: Those that act swiftly and decisively normally exit the process in better shape

New Finance – The other option to reducing costs is to inject new finance into the business

A surprising number of large, listed organisations have done rights issues. Clearly, these are not available to small, privately owned enterprises but other forms of equity might be. One organisation we know has done a ‘fund raise’ through its existing shareholders specifically to boost its balance sheet. The same organisation has also done a ‘debt/equity’ swap. This doesn’t introduce new finance but it does reduce debt on the balance sheet

You may need to consider all new finance options. Our key observation here is that strengthening the balance sheet isn’t a tomorrow job, it’s a today job.

Our second point on finance is the forensic management of cash.

When it comes to cash management and analysis of cash movement, you can’t do it often enough during a downturn – and you may well need to look at it differently: You need a model, not just a forecast. You need a tool that will enable you to model different scenarios and then understand the effect of cash burn. Your model must take account of differing revenue volumes – what if we only trade at 60% of last year’s revenue – and payment terms – what happens if clients delay payment and debtor days increase to 45, 60, 90?

You then need to maintain that cash model and review it weekly. Not just finance but the entire leadership team – Cash management or at least cash analysis becomes a team activity.

Here’s a summary of the 3 phases and the 5 themes:

If you would like to talk further about any of the elements of this approach, please get in touch, we’d be happy to answer any questions you might have.